ok-erm.ru

Tools

Metatrader 5 Supported Brokers

MT5 brokers list · PayPal · Skrill · Wire transfer · Credit/debit cards · Neteller · UnionPay · Bitcoin · Tether (USDT). The following list shows the main brokers with Metatrader 5. This directory includes mainly companies regulated by important bodies such as CySEC and FCA. I want to do forex trading as a beginner. I like mt5 compared to Tradingview. But i would want to know which broker should i use for Forex, trading at. With MetaTrader 5 you can organize comprehensive brokerage services in a variety of financial markets including Forex, stock exchange and Futures markets. ok-erm.ru is, hands down, the best broker for traders interested in exploring MT5. The newest version of the platform has many of the same features as. Meta Trader 5-MT5 Trading Platform user! AMP Futures offers Ultra-Cheap Commission, Super-Low Day Trading Margin to trade REAL CME exchange futures market. Our recommended brokers: · Plus · eToro · EVEST · DEGIRO · MyFundedFX. Starting a brokerage business with MetaTrader 5 is a fast and easy procedure. With this full-featured complete-cycle platform, you can organize brokerage. Top 9 Brokers Supporting MetaTrader 5 ; 1. FP Markets ; 2. AvaTrade ; 3. Tickmill ; 4. Pepperstone ; 5. Eightcap. MT5 brokers list · PayPal · Skrill · Wire transfer · Credit/debit cards · Neteller · UnionPay · Bitcoin · Tether (USDT). The following list shows the main brokers with Metatrader 5. This directory includes mainly companies regulated by important bodies such as CySEC and FCA. I want to do forex trading as a beginner. I like mt5 compared to Tradingview. But i would want to know which broker should i use for Forex, trading at. With MetaTrader 5 you can organize comprehensive brokerage services in a variety of financial markets including Forex, stock exchange and Futures markets. ok-erm.ru is, hands down, the best broker for traders interested in exploring MT5. The newest version of the platform has many of the same features as. Meta Trader 5-MT5 Trading Platform user! AMP Futures offers Ultra-Cheap Commission, Super-Low Day Trading Margin to trade REAL CME exchange futures market. Our recommended brokers: · Plus · eToro · EVEST · DEGIRO · MyFundedFX. Starting a brokerage business with MetaTrader 5 is a fast and easy procedure. With this full-featured complete-cycle platform, you can organize brokerage. Top 9 Brokers Supporting MetaTrader 5 ; 1. FP Markets ; 2. AvaTrade ; 3. Tickmill ; 4. Pepperstone ; 5. Eightcap.

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading. Top MetaTrader 5 Brokers in Oanda Open An Account Study Review Coinexx Open An Account Study Review RoboForex Open An Account. We're transitioning from MT4 to MT5. Existing MT4 accounts remain unaffected, but new accounts will not be supported on MT4. Streamline your trading experience. SUPPORTED BROKER: AMP Futures or AMP Global MT5 Open MetaTrader 5 / File / "Open Data Folder" folder; Copy "ok-erm.ru5" to "..\MQL5\Experts. MetaTrader 5 is chosen by traders all over the world. We present you with the best MT5 Forex brokers list on this page. US forex brokers once were on the verge of delisting the MT4 and MT5 platforms (made by Russian company Metaquotes) as a result of Apple's ban of these trading. MT5 Forex Brokers with the MetaTrader 5 Platform ; XM (ok-erm.ru), Submit Review. Excellent ; Exness, Submit Review. Excellent ; FP Markets, Submit Review. Start trading forex markets on Metatrader 5 Enjoy peace of mind with reliable data protection and complete compatibility with the entire MetaTrader 5. Best Metatrader 5 Brokers ; AvaTrade · Go to AvaTrade. AvaTrade offers MetaTrader 5 as a downloadable version for Windows and a mobile app for iOS and Android. Connect to hundreds of brokers and trade in financial markets using MetaTrader 5 for iPhone and iPad Compatibility. iPhone: Requires iOS or later. The features that made MetaTrader 4 the industry standard for forex trading have been upgraded in MetaTrader 5. Now a multi-asset platform, MT5 comes with. MetaTrader 5 High Leverage Forex Brokers ; Fibo Group · British Virgin Islands ; FxGlory · Saint Vincent and the Grenadines ; AMarkets · New Zealand Saint Vincent and. FP Markets - Best MT5 Broker in Australia · Pepperstone - Best ECN Broker with MT5 Support · AvaTrade - Best Commission-Free MT5 Account · ok-erm.ru - ASIC-. The platform supports all types of trade orders, including market, pending and stop orders as well as trailing stops. These four order execution modes are. With many brokers now offering MT5 alongside other platforms, traders have more choices than ever. In this article, we review the top Forex brokers that are. List Of Forex Brokers who offer MetaTrader5 ; NAGA, EET ; RoboMarkets, GMT+2 ; SunbirdFX, GMT+2 ; Swissquote Bank, CET. We recommend AvaTrade because it is a multi-regulated MT5 broker with an excellent reputation and best-in-class resources for beginners. 24/5 customer support. MetaTrader 5 is the best choice for the modern trader. Download MetaTrader 5 For brokers · For hedge funds. ok-erm.ruity. The largest community of. Top 5 Best MetaTrader (MT5) Brokers · HFM – Best Overall MT5 Broker · BlackBull Markets – Best Lowest Spread MT5 Broker · FP Markets – Best ECN MT5. Best multi-asset MT5 Forex broker by asset class ; Number of available physical shares, , N/A, , ; Number of available cryptocurrencies, 33, 11, 31, N.

Walmart Personal Checks To Order

Celebrate Rottweilers with Rottweiler Personal Checks from Walmart Checks Order your Rottweiler checks today! Singles - 4 pads/ checks, 12 deposit. Choose from various business checks, self-inking address stamps, business envelopes, check registers, and deposit solutions. Walmart Checks offers everything. Order Personal Checks Cheap() · Compuchecks Blank Check Paper - QuickBooks Checks - Check on Top (Blue Marble) · VersaCheck Personal Checks - Burgundy. Harland Clarke offers personal and business checks and check-related products. Personal Checks, Deposit Slips, and More. Order Personal Checks. Reorder your. Order high security business checks or designer personal checks. Also available are checkbook covers, stamps, return address labels and more. If you need to order checks for use with software that isn't listed, you can call Walmart and ask for custom formatting, but it is not clear what extra charge. Our prices are lower than Walmart Checks, and with this special offer you get the 2nd box of checks for 77 cents and Free Shipping too. Order today! Order checks from Walmart online including personal checks, business checks & designer checks. Shop checkbook covers, return address labels, stamps and more! Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store. Celebrate Rottweilers with Rottweiler Personal Checks from Walmart Checks Order your Rottweiler checks today! Singles - 4 pads/ checks, 12 deposit. Choose from various business checks, self-inking address stamps, business envelopes, check registers, and deposit solutions. Walmart Checks offers everything. Order Personal Checks Cheap() · Compuchecks Blank Check Paper - QuickBooks Checks - Check on Top (Blue Marble) · VersaCheck Personal Checks - Burgundy. Harland Clarke offers personal and business checks and check-related products. Personal Checks, Deposit Slips, and More. Order Personal Checks. Reorder your. Order high security business checks or designer personal checks. Also available are checkbook covers, stamps, return address labels and more. If you need to order checks for use with software that isn't listed, you can call Walmart and ask for custom formatting, but it is not clear what extra charge. Our prices are lower than Walmart Checks, and with this special offer you get the 2nd box of checks for 77 cents and Free Shipping too. Order today! Order checks from Walmart online including personal checks, business checks & designer checks. Shop checkbook covers, return address labels, stamps and more! Cash checks for less · $4 maximum fee¹. For preprinted checks cashed up to $1, · Get cash in a flash. Bring your check & valid ID to a Walmart store.

Visit Walmart Online · We Recommend · Choose the Checks You Want · We Recommend · Verify Your Check Choice · Enter Your Banking Information · Preview the Information. Visit ok-erm.ru to select from our wide variety of Personal checks, Business checks, Deposit products, and Accessories. Your search for high-quality personal checks at cheap prices ends here. Order classic safety checks for maximum savings starting at $ per 40 singles or $3. Order checks from Walmart online including personal checks, business checks & designer checks. Shop checkbook covers, return address labels, stamps and. Ordering basic personal checks from Walmart starts at $ with an additional $ processing fee. The price of high-security checks costs around $ Order Personal Checks Cheap() · Compuchecks Blank Check Paper - QuickBooks Checks - Check on Top (Blue Marble) · VersaCheck Personal Checks - Burgundy. 3 reviews of WALMART CHECK PRINTING "One star only because I can NOT give it negative stars. I placed an order for some checks, was told the order was on. Your search for high-quality personal checks at cheap prices ends here. Order classic safety checks for maximum savings starting at $ per 40 singles or $3. To order a pack of personalized checks, log in to the Green Dot app or your online account. Once logged in, select Paper Checks from the Pay menu. Enter the numbers from the bottom of an existing check for this account. Starting with the numbers at left, enter all numbers with no spaces, letters or. Why would you need to call Ally to order checks? They can order them online or through the app. They are also free. Visit ok-erm.ru to select from our wide variety of Personal checks, Business checks, Deposit products, and Accessories. You can simply go to Checks, Personal Checks, Business Checks & Designer Checks to order an array of personal checks. All Walmart stores accept personal checks as payment at the register. However, you can't use a personal check to pay for a ok-erm.ru order. Shop for Blank Checks in Money Handling. Buy products such as Blank Blue Computer Checks / " x 11" Blank Business Checks / Laser And Ink Jet Checks. Harland Clarke offers personal and business checks and check-related products. Personal Checks, Deposit Slips, and More. Order Personal Checks. Reorder your. Check reorders may be placed directly from our provider, Harland Printing Products, on their secured site. Because your order is placed directly with Harland. TO: All Persons who Purchased Weighted Goods and/or Bagged Citrus in-person at a Walmart retail store, supercenter, or neighborhood market in the United. Yes. Walmart sells large selection of personal checks, at low prices. Do shop around to compare security features and turnaround time. See below for a. Money Center. Money Services Home · Affirm. Affirm · Bill Pay. Bill Pay · Check Cashing. Check Cashing · Check Printing. Check Printing · One debit. One Cash. One.

What Happens In Foreclosure

What Happens If You Foreclose on a House? Foreclosure means a lender is looking to take possession of a home when the borrower – the homeowner – isn't making. Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by. Foreclosure begins when the lawsuit is filed. A homeowner is considered “in foreclosure” until a judgment is made by the court. If you do not know the exact. The Statement of Claim is the first step in the foreclosure action. The lender must have filed the Statement in the Court and served a copy on you. The. A foreclosure is a lawsuit filed by a mortgage holder or lender against a borrower. This usually occurs after the borrower misses one or more mortgage payments. Tenants who live in foreclosed residential properties are allowed to stay in their homes until they are given at least 90 days advance notice to vacate, with. Throughout the Foreclosure Process. You have the right to stay in your home and the duty to maintain your property unless and until a court orders you to vacate. 90 Day Pre-foreclosure Notice. Lender must mail you information on getting help at least 90 days before starting a court case. Do not wait to get help. In general, mortgage companies start foreclosure processes about months after the first missed mortgage payment. Late fees are charged after days. What Happens If You Foreclose on a House? Foreclosure means a lender is looking to take possession of a home when the borrower – the homeowner – isn't making. Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by. Foreclosure begins when the lawsuit is filed. A homeowner is considered “in foreclosure” until a judgment is made by the court. If you do not know the exact. The Statement of Claim is the first step in the foreclosure action. The lender must have filed the Statement in the Court and served a copy on you. The. A foreclosure is a lawsuit filed by a mortgage holder or lender against a borrower. This usually occurs after the borrower misses one or more mortgage payments. Tenants who live in foreclosed residential properties are allowed to stay in their homes until they are given at least 90 days advance notice to vacate, with. Throughout the Foreclosure Process. You have the right to stay in your home and the duty to maintain your property unless and until a court orders you to vacate. 90 Day Pre-foreclosure Notice. Lender must mail you information on getting help at least 90 days before starting a court case. Do not wait to get help. In general, mortgage companies start foreclosure processes about months after the first missed mortgage payment. Late fees are charged after days.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or. What is commonly called a “foreclosure” is a lawsuit that the mortgage holder files against a homeowner in the supreme court where the property is located. The. If you do not make your mortgage payments, your lender can take your home. The process they use to take your home is called foreclosure. This is the legal. The lender can then choose to sell the property through an auction or via a traditional property sale. Pros Of Buying A Foreclosed Home. While spotting a. They must give you a 90 day notice to move out, even if you do not have a written lease. You have the right to stay until the end of your lease term, which. The foreclosing entity must send a notice of foreclosure sale to the homeowner at least 14 days prior to foreclosure sale date. The foreclosure sale occurs on. A mortgage foreclosure is the legal process that can happen when a person borrows money from a bank or lender to buy a home. In exchange for the loan. Simply put, foreclosure is the legal process that allows lenders to recover the balance owed on a defaulted loan by taking ownership of and selling the. When a homeowner stops paying on a loan used to purchase a home, the home is deemed to be in foreclosure. What it ultimately means is that the ownership of. You may present your case at the hearing and the judge will decide what to do next. If you have a valid Answer, the judge may require the lender to give you. Here are some suggestions for identifying scams and what to do if you feel that you have been a victim: What happens after the foreclosure sale has taken. Foreclosure is a process by which a lender that is servicing a mortgage loan repossesses the property and forces the borrower out of the home because he or she. No. The court seals (closes) records about tenants who are evicted after a foreclosure sale. The court cannot tell anyone that you were evicted. Your identity. If you fail to work out a deal before the court orders the foreclosure, the lender can sell your house, no matter how close you were to an agreement. If you. A Foreclosure Complaint asks the Court to allow the mortgagee to recover the property pursuant to the provisions of a mortgage instrument. The foreclosure. If you do not make your mortgage payments, your lender can take your home. The process they use to take your home is called foreclosure. This is the legal. When all else fails, sometimes the best thing to do when faced with foreclosure is to just walk away. A mortgage release gives a homeowner a legal means of. This occurs when the sale of the foreclosed property does not cover the full amount owed on the mortgage. In this case, the lender may seek a deficiency. The first step in a foreclosure occurs before the “legal” aspect even begins. The mortgage holder must send you a pre-foreclosure notice that gives you. The lender gets a credit up to the amount of the borrower's debt. The highest bidder at the sale becomes the new owner of the property. What Happens After a.

Dividend Investments

How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul. Dividend-paying stocks are like the Volvos of the investing world. They're not fancy at first glance, but they have a lot going for them when you look deeper. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. And. Because the dividend is income, you'll owe taxes on that amount (if you invest in a taxable account). Think about dividends before investing a large amount. Investments · Financial advice · Asset management · Insurance · Investments Read frequently asked questions about common share dividends, preferred shares. Is all the talk about dividend-paying stocks just a fad? Or is there real merit to the dividend argument, particularly at this point in market history? Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company. Generally speaking, you want to find companies that not only pay steady dividends but also increase them at regular intervals—say, once per year over the past. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul. Dividend-paying stocks are like the Volvos of the investing world. They're not fancy at first glance, but they have a lot going for them when you look deeper. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. And. Because the dividend is income, you'll owe taxes on that amount (if you invest in a taxable account). Think about dividends before investing a large amount. Investments · Financial advice · Asset management · Insurance · Investments Read frequently asked questions about common share dividends, preferred shares. Is all the talk about dividend-paying stocks just a fad? Or is there real merit to the dividend argument, particularly at this point in market history? Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company. Generally speaking, you want to find companies that not only pay steady dividends but also increase them at regular intervals—say, once per year over the past. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks.

Dividend-paying companies can offer investors attractive returns, tax benefits and a steady stream of income. Brought to you by AGF Insights: Expert. A dividend investing strategy can be handy if you're retired and need extra income. Reinvesting dividend checks can give your portfolio extra power. For example, income investors might design a portfolio with target proportions for bonds, dividend- paying stocks, real estate, and cash equivalents. as with. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. Dividend stocks are stocks of companies that regularly pay shareholders a piece of their earnings. Like an a additional piece of the pie? Listen to Ian Duncan MacDonald's Safe Dividend Investing podcast on Apple Podcasts. Top High Dividend Yield Stocks. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. And. This guidebook first outlines a step-by-step strategy for identifying underpriced dividend-paying companies, then shows you how to assemble the best of those. Some people pursue a strategy of investing in these dividend US stocks so they can get consistent income, while also benefiting from any appreciation in. Dividend stocks are stocks of companies that regularly pay shareholders a piece of their earnings. Like an a additional piece of the pie? r/dividends: A community by and for dividend growth investors. Let's make money together! Follow the basic rules of dividend investing as well as keeping simple tips and tricks in mind. In this article, we present the 10 rules that will make you a. Sector concentration and the prevailing low-yield environment present unique challenges to dividend investors who want to focus on the home market. Why dividends matter. Not every stock pays a dividend, but a steady, dependable dividend stream can provide nice ballast to a portfolio's return. A stock's. Dividends are regular payments of profit made to investors who own a company's stock. Updated Aug 13, · 4 min read. Profile photo of Arielle O'Shea. Here's a list of dividend-paying stocks you might want to consider and some of the most important things to look for in top dividend stocks. In Fisher Investments' view: Dividend stocks are simply, well, stocks. They possess no magic—and overreliance on them may raise risks many investors overlook. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they compare to other. Those are the Cabot Dividend Investor, a service that has beaten the market since its February inception, and Cabot Income Advisor, an advisory that.

Highest Money Market Rates

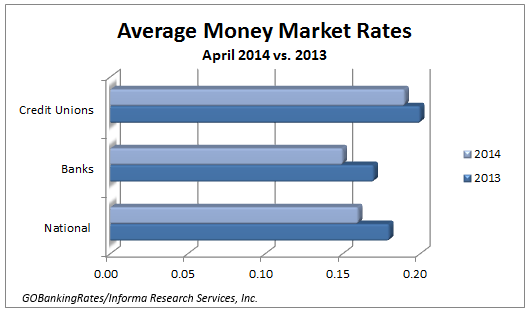

Tap into your account whenever you need it by using an ATM card, debit card or check, transferring money or accessing one of the largest ATM networks in America. % APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. Schwab Value Advantage Money Fund® – Investor Shares (SWVXX) · % · $0* ; Schwab Value Advantage Money Fund® – Ultra Shares (SNAXX) · % · $1,, Operating band, high , Bank rate , Target rate , , Symbol legend.. not available. The variable APY applicable to the account each day is determined by the ending daily collected balance as follows: % for $, and up; % for $50, Money Market accounts at Hughes Federal Credit Union in Arizona offer higher interest rates than traditional savings. High Yield, Premium, Ultimate. Compare our money market funds ; Fund · Vanguard Federal Money Market Fund ; Initial investment $3, ; Average 7-day SEC yield as of. September 06, · %. Our top picks for best money market account rates are Vio Bank (%), Quontic Bank (%) and EverBank (%), but you can get rates as high as % from. Earn our best interest rates on your savings while keeping your money liquid and available. Huntington explains money market accounts (MMAs). Tap into your account whenever you need it by using an ATM card, debit card or check, transferring money or accessing one of the largest ATM networks in America. % APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. Schwab Value Advantage Money Fund® – Investor Shares (SWVXX) · % · $0* ; Schwab Value Advantage Money Fund® – Ultra Shares (SNAXX) · % · $1,, Operating band, high , Bank rate , Target rate , , Symbol legend.. not available. The variable APY applicable to the account each day is determined by the ending daily collected balance as follows: % for $, and up; % for $50, Money Market accounts at Hughes Federal Credit Union in Arizona offer higher interest rates than traditional savings. High Yield, Premium, Ultimate. Compare our money market funds ; Fund · Vanguard Federal Money Market Fund ; Initial investment $3, ; Average 7-day SEC yield as of. September 06, · %. Our top picks for best money market account rates are Vio Bank (%), Quontic Bank (%) and EverBank (%), but you can get rates as high as % from. Earn our best interest rates on your savings while keeping your money liquid and available. Huntington explains money market accounts (MMAs).

Compare current money market account rates for September · Vio Bank — % APY · CFG Community Bank — % APY · UFB Direct — % APY · Quontic Bank — Enjoy a high yield on your account balance with the added benefits of a checking account, including a free debit card and check writing privileges. Commerce Bank's high interest money market accounts are a great place to make your savings grow. View our current interest rates for money market accounts. High Yield Money Market ; $ to $9,, %, % ; $10, to $99,, %, % ; $, and above, %, %. With the Fifth Third Relationship Money Market Account, interest rates vary based on your balance—the larger your balance, the higher your rates. Fifth Third. Money market account need to know. · There is a required minimum account balance and opening deposit of $10, in new money. · If the minimum daily balance. With no maintenance fees, the CIBC Agility™ High-Interest Savings Account helps you grow your money faster Savings, Money Market and NOW Accounts · EasyPath. Relationship Money Market: Relationship Rates (monthly account requirements** met) ; $10, - $49,, %, % ; $50, - $99,, %, %. Money Market Tier 4, %, %, $2,, $, Money Market Tier 5, %, %, $2,, $, High-Yield Money Market Rates. Product1, Dividend Rate. UFB Freedom Checking is a non-interest-bearing account. To receive the additional % Annual Percentage Yield (APY) on a UFB Savings or Money Market account. Money Market Plus Account Rates · $10,$24, · % · $25,$49, · % · $50,$99, · % · $,+ · %. Currently, some of the best money market accounts offer annual percentage yields (APYs) as high as %%. And luckily, it's pretty easy to find these top-. Open a new Truist One Money Market Account and earn % annual percentage yield (APY). Offer available to new Truist One Money Market Account clients only. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. Money Market Rates ; $, or more, % ; APY=Annual Percentage Yield. The APY may change after account opening. What is a good money market rate? Money market accounts pay a wide range of interest rates, but the most competitive options available today top 5%. These. Money Market Savings Account ; $0 to $2,, % ; $2, to $9,, % ; $10, to $24,, % ; $25, to $49,, % ; $50, and over, %. The funds can be popular in high-interest environments because they provide a steady stream of investment income, typically with less volatility than you might. Limited-time introductory offer. Earn % APY1 for the first 3 months with a minimum deposit of $25, when you open a Thrive Money Market account. Learn. Earn % APY1 when you maintain a $, balance or more. Interest Rate. As high as % APY1.

Financial Advisor 1 Percent Fee

Fee-Only financial advisors may be paid hourly, as a retainer, as a percentage of assets (AUM), or as a flat fee, depending upon the planner you choose. – Flat fee of $2, to $4, for a one-time service. The costs vary greatly, as you can see. Why do the costs vary significantly? In a recent study, McKinsey found that the advisors covered by their survey were charging an average annual fee of just over 1% on assets under management for. They charge a percentage based fee on your investment accounts. If an AUM advisor charges a 1% fee, and you have $1 million, your fee is $10, per year. Further, a Registered Investment Advisor must explain upfront how they receive compensation. Fees range but generally average somewhere between % of the. For example, if you were to hire an advisor under the AUM fee structure, and they managed $1 million dollars for you, their annual fee would be 1% of those. But if you pay a financial advisor 1%, you'd only have $1,, That's more than $, going into your advisor's pockets in fees! By the. The minimum yearly fee is $ per client, not per account (this is an overall minimum, not in addition to the percentage fee). Most advisors retain a percentage of your money when they manage it for you—commonly referred to as an “Assets Under Management” fee (AUM). Fee-Only financial advisors may be paid hourly, as a retainer, as a percentage of assets (AUM), or as a flat fee, depending upon the planner you choose. – Flat fee of $2, to $4, for a one-time service. The costs vary greatly, as you can see. Why do the costs vary significantly? In a recent study, McKinsey found that the advisors covered by their survey were charging an average annual fee of just over 1% on assets under management for. They charge a percentage based fee on your investment accounts. If an AUM advisor charges a 1% fee, and you have $1 million, your fee is $10, per year. Further, a Registered Investment Advisor must explain upfront how they receive compensation. Fees range but generally average somewhere between % of the. For example, if you were to hire an advisor under the AUM fee structure, and they managed $1 million dollars for you, their annual fee would be 1% of those. But if you pay a financial advisor 1%, you'd only have $1,, That's more than $, going into your advisor's pockets in fees! By the. The minimum yearly fee is $ per client, not per account (this is an overall minimum, not in addition to the percentage fee). Most advisors retain a percentage of your money when they manage it for you—commonly referred to as an “Assets Under Management” fee (AUM).

The average percentage, based on the number of assets under management (AUM) for ongoing advising, is about 1% annually, but an advisor may charge less if you. What percentage do most financial advisors charge? The typical fee has held steady at roughly 1% on the first $1 million of assets each year. But some advisors. Depending upon the investment advisory program you select, you may also be charged a professional money manager's fee as well as additional fees for overlay. 3. Fee to the firm or advisor. Most advisors charge a percentage based on the amount of assets they manage for their client, or AUM (assets under management). Most Advisory fees settle somewhere around 1% of your assets, annually, to cover all costs (advice, planning, account and transaction fees, etc.). Investment Advisors can charge per transaction from 1% to 3% or make fee-based arrangements with clients. Fee-based programs range mostly between 50 basis. This fee structure causes fees to grow exponentially as your wealth increases. For example, assume you have $3,, invested with a traditional Wall Street. What percentage do most financial advisors charge? You can typically expect to pay a 1% annual fee on your assets managed by a financial advisor. The. She also found dual registrants charge an average of % on assets under management. This is much higher than the 1% fee most registered investment advisers. At Merrill, you can work one-on-one with your dedicated financial advisor to help you build a comprehensive financial strategy for an asset-based fee in an. Charging a percentage based on assets under management (AUM)—say, 1% of the investment account value. The engagement may or may not include planning and/or. In the United States the average fee typically charged by financial advisors is about 1% of your investment assets, give or take. Is that rate. The typical starting point for advisory fees is 1%, which means the advisor needs to provide 1% or more value to clients to earn their fees. That can be tough. They may charge hourly fees of $ to $, or a percentage fee, normally around 1% of the value of the client's assets under management. A fee-only advisor is. For example, if you were to hire an advisor under the AUM fee structure, and they managed $1 million dollars for you, their annual fee would be 1% of those. Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary based on the type and amount. As a fee-only fiduciary financial advisors, our only compensation comes from you, our client, as a fixed percentage of assets under our management. We generally charge an annual fee of one percent of assets or less. This single fee provides for all of our portfolio management, financial planning, and. This annual fee can be anywhere between % and 1% of the total assets. Note, however, that the percentage is not calculated on the total assets of the. How you pay is broadly based on the types of services we provide: investment advisory (percentage of assets held in your account), brokerage (sales charge on.

Make A Payment At Best Buy

Endless rewards where Visa® is accepted. Pay your bill, check your balance and more. Manage Account* Get the most out of your Card. 1. Shop Online. Shop ok-erm.ru® and add items to your cart. Step 2 alt text · 2. Use your Citi® Card. At checkout, enter your eligible Citi credit card. Step 3. Call Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through our automated system. Remember me on this computer. Are you looking to access your. ok-erm.ru business account? Click Here. We provide support across a continuum of care ; Consumers & Caregivers. Making health technology work for you and those who support you. ; Healthcare Providers. In-Store · Cash · Debit · Visa · MasterCard · American Express · Best Buy Gift Card · Best Buy Financing with Fairstone™ · Monthly Subscription. You can only make one online payment per day. You may schedule future payments as far as 45 days in the future. If you do not make one Online Payment at least. Financing details: *As of the last 30 days, My Best Buy®, Magnolia™ & Pacific Sales™ Credit Card Purchase APRs: variable %–%, non-variable %–. Online: Make a payment online or check your balance with your Citibank Account Online. · By phone: Call · By text: Text* PAY to using the. Endless rewards where Visa® is accepted. Pay your bill, check your balance and more. Manage Account* Get the most out of your Card. 1. Shop Online. Shop ok-erm.ru® and add items to your cart. Step 2 alt text · 2. Use your Citi® Card. At checkout, enter your eligible Citi credit card. Step 3. Call Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through our automated system. Remember me on this computer. Are you looking to access your. ok-erm.ru business account? Click Here. We provide support across a continuum of care ; Consumers & Caregivers. Making health technology work for you and those who support you. ; Healthcare Providers. In-Store · Cash · Debit · Visa · MasterCard · American Express · Best Buy Gift Card · Best Buy Financing with Fairstone™ · Monthly Subscription. You can only make one online payment per day. You may schedule future payments as far as 45 days in the future. If you do not make one Online Payment at least. Financing details: *As of the last 30 days, My Best Buy®, Magnolia™ & Pacific Sales™ Credit Card Purchase APRs: variable %–%, non-variable %–. Online: Make a payment online or check your balance with your Citibank Account Online. · By phone: Call · By text: Text* PAY to using the.

1. Download the Sezzle App. · 2. Search for and click Best Buy. · 3. Click Pay with Sezzle. · 4. Your Best Buy purchase is split into 4 interest-free payments over. If you have the BB credit card and pay through the app, be REALLY CAREFUL not to tap on the 'make a payment' part UNLESS YOU REALLY PLAN TO PAY RIGHT THEN!! Best Buy logo. Nike logo. Dillard's logo. Target logo. Office Depot logo There you can make additional payments as desired or pay off the loan in. Gift card is made of at least 43 percent recycled content and recyclable by bringing it back to any Best Buy retail location. All terms enforced except where. Yes, you can pay your credit card bill by cash or check in any Best Buy store. You also can pay online, by phone, or by mail. Average Best Buy hourly pay ranges from approximately $ per hour for Field Technician to $ per hour for Software Engineer. The average Best Buy salary. How do I make payments? · Go to your online banking website. · Search for Fairstone among your payee list. · Select Fairstone- Retail Financing as the payee · If. Yes, you can pay your Best Buy® Credit Card bill by phone. To make your Best Buy® Credit Card payment over the phone, call and follow the. Use a U.S. credit or debit card to make a purchase; Use the Zip app (for in-store purchases). How much does using Zip cost? Customers may be charged. Best Buy has simplified tech shopping, with warp-speed checkout, Curbside Pickup, limited runs, and can't-miss deals. Shop from home or enhance your. Shop for pay my bill for best buy at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Learn about deferred financing with Best Buy, including how it works, payment requirements, account information, helpful resources and FAQs. Shop for pay best buy credit card citi at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. You may continue to make partial payments at your discretion until the qualifying merchandise is paid for in full. Please note that partial payment does not. With the My Best Buy® Visa® card, you can earn points per $1 spent at gas stations (3% back in rewards), 1 point per $1 spent at restaurants, bars and. How to use financing with Affirm at Best Buy · Shop at Best Buy · 2. Request a virtual card from Best Buy · 3. Make simple and easy payments. During the promotional period for the special financing offer, Best Buy credit cardholders do not have to pay interest if they make their fixed monthly payments. Payment Options. Support & Services. Rewards & Membership. Partnerships. About Sign in or Create Account. Get the latest deals and more. Email Address. Download the Afterpay app and search for Best Buy. Open the Best Buy store and start shopping. Check out with Afterpay and choose how to pay. a man in a. Why not use the apple card and just save up before you make any purchases? Then you'd have the cash available to pay off the card in the.

Rates For Refinance With Cash Out

On Sunday, September 01, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. You'll pay a fee between % and % of the loan amount for VA cash out refinancing. Some disabled veterans and surviving spouses may be exempt from paying. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a $, home loan refinance, you could pay between $4, and $10, in closing. As a direct lender, loanDepot has access to low refinance rates and we can help make the process of refinancing your home fast and easy. It typically falls between and Keep in mind; credit scores affect loan rates differently. If your score is on the lower end, expect to be charged a. You can refinance your existing loan by using a rate-and-term refinance to get a lower interest rate, change the loan term or length, or change the loan type. You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash-out refinance are similar. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 6 basis points to On Sunday, September 01, , the national average year fixed refinance APR is %. The average year fixed refinance APR is %, according to. You'll pay a fee between % and % of the loan amount for VA cash out refinancing. Some disabled veterans and surviving spouses may be exempt from paying. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a $, home loan refinance, you could pay between $4, and $10, in closing. As a direct lender, loanDepot has access to low refinance rates and we can help make the process of refinancing your home fast and easy. It typically falls between and Keep in mind; credit scores affect loan rates differently. If your score is on the lower end, expect to be charged a. You can refinance your existing loan by using a rate-and-term refinance to get a lower interest rate, change the loan term or length, or change the loan type. You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash-out refinance are similar. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 6 basis points to

Today's competitive refinance rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %.

These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. The loan proceeds are first used to pay off your existing mortgage(s), including closing costs and any prepaid items (for example real estate taxes or. Generally, borrowers need at least 20% equity in their property to be eligible for cash-out refinances. As with most loans, there will be fees associated with. Rate-and-term refinance refers to the refinancing of an existing mortgage for the purpose of changing the interest rate or loan term without taking. Cash-out refinance rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed. Rate. %. APR. The current average year fixed refinance rate climbed 10 basis points from % to % on Thursday, Zillow announced. The year fixed refinance rate on. The Annual Percentage Rate is %. No prepayment penalty. Payment shown does not include taxes and insurance. The actual payment amount will be greater. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. Tips for Using the Cash-Out Calculator · Your home's current market value — an estimate of the amount it would sell for in the current real estate market · Your. For first-time users of the VA loan benefit, the VA Funding Fee on a Cash-Out refinance is %. For those reusing their benefit, the VA Funding Fee on a Cash-. Current Mortgage Refinancing Rates ; VA Loans · % · % ; VA Streamline (IRRRL) · % · % ; Military Choice · % · % ; Conventional Fixed Rate. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. Check cash-out fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. Refinance Rates Today · Term Length Options: · Rate Range: · Year Fixed Rate · % - % APR · Year Fixed Rate · % - % APR · Year Fixed Rate. VA Cash-out Refinance Loan · % · %APR · Features. Refinance up to 90% of the value of your home. ; VA Interest Rate Reduction Refinance Loan (IRRRL). Yes. Closing costs for a cash-out refinance loan are usually about % of your newly established mortgage. So for a $, property, the estimated. Use that extra cash to: · Lower interest rates than a personal loan or credit card · No additional monthly payments · Longer repayment terms · No prepayment. Cash-out Refinance · % · %. Refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. You'll pay the same types of fees for a cash-out. Whatever you need it for, a cash-out refinance lets you use your home's equity to cover these costs at a lower rate than many other loans and credit cards.

How To Choose A Kitchen Remodeling Contractor

How to Choose the Right Kitchen Remodeling Contractor · 1. Do Your Research · 2. Ask for Referrals · 3. Get Multiple Estimates · 4. Check Licensing and. 1 Understanding the Role of a Kitchen Remodel Contractor · 2 Assessing Your Remodeling Needs · 3 Researching Potential Contractors · 4 Evaluating Credentials and. Determine your budget and needs/wants. · Research kitchen remodel contractors. · Interview potential contractors and check their references. The Importance of Communication. Good communication is critical to a successful kitchen renovation. Make sure your contractor understands your expectations and. Check Online Reviews You should do an online search for “kitchen remodeling contractors near me” and check out the reviews and testimonials. This will return a. Start by researching local contractors who specialize in high-end kitchen remodels such as May Construction. Look for portfolios that showcase their previous. 1. Check References "You should always ask the contractor for three customer references on jobs completed within the last year," says Rico. "Call those. A kitchen remodel is a significant investment. Therefore, treat contractor selection as you would any hiring process – interview them in person. Gauge their. How to Select the Best Kitchen Remodeling Contractor · Make a List of Kitchen Remodeling Contractors · Review Each Contractor's Kitchen Remodel Portfolio · Ask. How to Choose the Right Kitchen Remodeling Contractor · 1. Do Your Research · 2. Ask for Referrals · 3. Get Multiple Estimates · 4. Check Licensing and. 1 Understanding the Role of a Kitchen Remodel Contractor · 2 Assessing Your Remodeling Needs · 3 Researching Potential Contractors · 4 Evaluating Credentials and. Determine your budget and needs/wants. · Research kitchen remodel contractors. · Interview potential contractors and check their references. The Importance of Communication. Good communication is critical to a successful kitchen renovation. Make sure your contractor understands your expectations and. Check Online Reviews You should do an online search for “kitchen remodeling contractors near me” and check out the reviews and testimonials. This will return a. Start by researching local contractors who specialize in high-end kitchen remodels such as May Construction. Look for portfolios that showcase their previous. 1. Check References "You should always ask the contractor for three customer references on jobs completed within the last year," says Rico. "Call those. A kitchen remodel is a significant investment. Therefore, treat contractor selection as you would any hiring process – interview them in person. Gauge their. How to Select the Best Kitchen Remodeling Contractor · Make a List of Kitchen Remodeling Contractors · Review Each Contractor's Kitchen Remodel Portfolio · Ask.

First and foremost, a trustworthy contractor has the expertise and experience to handle all aspects of a kitchen remodeling project. From design and planning to. How to Choose a Kitchen Remodeling Contractor · 1 Ask Around for Referrals · 2 Be Cautious with Online Reviews · 3 Look at Past Projects · 4 Research Credentials · 5. Ultimately, your choice will come down to personal preference. If you have a specific designer you know you want to work with, hiring a general contractor will. Here are the pro tips on how to hire your remodeling contractor in California based on your budget, contractor bids, permits, legalities, insurance, and many. How to Find the Right Contractor, According to an HGTV Expert · 1. Check References · 2. Scour the Internet · 3. Only Hire Insured Contractors. To give you an accurate estimate, the specialists will have to do a detailed assessment of your kitchen. The materials, appliances, and fixtures of your choice. To give you an accurate estimate, the specialists will have to do a detailed assessment of your kitchen. The materials, appliances, and fixtures of your choice. Look for a contractor who has been in business for several years and has a portfolio of successful projects. A contractor who has experience with your specific. If a contractor can't get to your project for a few months, that's a sign he/she is in high demand. High demand can mean he/she is really good. This can also. When interviewing potential contractors, make sure to ask about their experience with kitchen remodels, as well as any references they can provide. Ask about. The first thing that you should always do is check the contractor's credentials. Every legitimate contractor should have a license granted to them by the state. Look for a contractor who has specialized experience in kitchen remodeling. Consider their track record of successful projects and ask for references from past. What else should I ask a potential contractor for my kitchen remodel? · 1 Ask them who is going to cut the doors down after carpet is installed. Determine a budget that aligns with your remodeling goals. A clear budget will help you and potential contractors understand the scope of the project and make. Shop local when looking for the best general contractor to work on your kitchen project. Local kitchen remodeling contractors will be familiar with local codes. How To Choose The Best Kitchen Remodel Contractors? · Step 1- Make A List Of Contractors · Step 2- Look At Credentials And Cross-Reference · Step 3- Try To Get. It is important to ask lots of questions about the contractor and about the experiences the person had with them. That can give you an idea of what to expect. Ultimately, your choice will come down to personal preference. If you have a specific designer you know you want to work with, hiring a general contractor will. Choosing A Kitchen Remodeling Contractor · Ask For Recommendations · Check Their Credentials · Interview Potential Builders · Ask About References And Previous. Check their website. Almost all contractors today have a website that will showcase projects they have worked on and provide information about their services/.

Can You Get A Credit Card The Same Day

How to Get a Credit Card for Same Day Use · Online (or phone, if applicable) credit card application · Instant approval of that application · If eligible, you'll. We'll give you your card the same day at the bank, so you don't have to wait for one to arrive in the mail and set it up yourself. Visa® Credit Cards. Add a. With Instant Card Number by American Express, eligible Card Members can immediately start shopping and using their new Card benefits today. you would if using a credit card with an outstanding balance. You can even use your debit card to get cash when you make purchases at a store. What kinds of. If you wait longer than two days to report the card as lost or stolen, your can help get your credit card balance down to a manageable amount. 4. credit union as interchange income. You can't get cash back from your account. Running a debit card as “credit” is not the same thing as using a credit card. The average Visa® or Mastercard® may be approved in minutes and shipped within days, provided you meet the credit criteria. days, there are steps you can take. Yes, you can apply for multiple cards the same day. In general, there's absolutely no issue with applying for multiple credit cards the same day. I'm not just. You'd be better off going for a charge card. Though I'm not sure if the same restrictions would apply as with credit since it's brand new. Most. How to Get a Credit Card for Same Day Use · Online (or phone, if applicable) credit card application · Instant approval of that application · If eligible, you'll. We'll give you your card the same day at the bank, so you don't have to wait for one to arrive in the mail and set it up yourself. Visa® Credit Cards. Add a. With Instant Card Number by American Express, eligible Card Members can immediately start shopping and using their new Card benefits today. you would if using a credit card with an outstanding balance. You can even use your debit card to get cash when you make purchases at a store. What kinds of. If you wait longer than two days to report the card as lost or stolen, your can help get your credit card balance down to a manageable amount. 4. credit union as interchange income. You can't get cash back from your account. Running a debit card as “credit” is not the same thing as using a credit card. The average Visa® or Mastercard® may be approved in minutes and shipped within days, provided you meet the credit criteria. days, there are steps you can take. Yes, you can apply for multiple cards the same day. In general, there's absolutely no issue with applying for multiple credit cards the same day. I'm not just. You'd be better off going for a charge card. Though I'm not sure if the same restrictions would apply as with credit since it's brand new. Most.

How to apply for a credit card Thinking of getting a credit card? Applying for a credit card is generally quick and easy, and can often be done online, over. TD credit cards that suit you. Answer a few simple questions and we will suggest the ideal TD credit card for you. You'll receive your card within 10 business days after you're approved. Before you use your new card, you can activate it in one of several ways: Log in to the. Yes, if you have been approved for an IKEA Visa Credit Card in an IKEA store or online, you will be able to use your newly opened account on the same day. Most major banks support “instant use” upon approval through a digital wallet. The key part of your question is “which you can get” about which. Fill out the amount, select the date and make it a recurring payment. You can assign your payment to any day between the 1st and the 28th of the month, as long. More rewards on the things you buy every day. 4X unlimited points on dining If you have a FNBO card (it says FNBO on the back), we'll send you a. Yes, you can apply for multiple cards the same day. In general, there's absolutely no issue with applying for multiple credit cards the same day. I'm not just. Temporary credit cards are valid for 14 days after an account is approved or until the new plastic credit card has been received and activated. If you apply. Instant-issued cards so you can replace lost or damaged cards the same day at a branch. will receive monthly payouts instead of quarterly payments for the. Certain issuers provide your credit card number (or a temporary one) to use right after you're approved, instead of making you wait business days until. Most in store credit cards can be used the same day you apply. You would be given a temporary slip that has the credit card info and can be used to pay for the. Can I get a credit card in one day? Yes, it's possible to get a credit card in one day with an instant approval credit card, but it's worth keeping in mind. Filling out a credit card application is likely the easiest part of the process. You typically have the option of applying over the phone, in person, or online. You can change it once each calendar month, or make no change and it stays the same. 0% † Intro APR for your first 15 billing cycles for purchases, and for any. That can slow things down by a few days or even a few weeks, depending on the credit card company's review policies. If you haven't heard from the credit card. Easily and securely make same-day credit card payments online, over the phone, or at an ATM. Payment options. Pay online. Sign on to Wells Fargo Online® or. If approved, get your card the same day at a Founders office near you. Rates as low as. % APR1. Annual Fees. $0 Apply for a Life Rewards Mastercard®. Extra. That can slow things down by a few days or even a few weeks, depending on the credit card company's review policies. If you haven't heard from the credit card. Pay for everyday purchases quickly and conveniently with contactless PNC Visa Credit Cards. Get the same level of security when you tap as you do when you.